The new Foreign Investment Law (“FIL”) was passed and published on March 15, 2019 and will take effect on January 1st, 2020.

According to the FIL and its draft implementing regulation published by the People’s Republic of China (“PRC”) Ministry of Justice for public comments on November 1st, 2019 (the “Draft Implementing Regulation”), foreign-invested enterprises (“FIE”) incorporated under the form of Wholly Foreign-Owned Enterprises (“WFOE”), Equity Joint Ventures (“EJV”) or a Cooperative Joint Ventures (“CJV”) (in the nature of limited liability company) before the effectiveness of the FIL shall now be subject to mandatory provisions of the PRC Company Law, as applicable.

Why negotiating with your JV partner?

For WFOEs, the change process should be straightforward as the PRC Wholly Foreign-Owned Enterprises Law was already quite similar to the PRC Company Law. Still, updating a WFOE’s articles of association may imply some negotiations with your partners if the governance is at the WFOE level. In our experience, most of the WFOEs are held by an offshore holding, the governance of which is generally determining the control on the decisions of the WFOE.

The real challenge for foreign investors falls on EJV and CJV (“JV”) as updating their articles of association and joint venture agreement will require to start new negotiations with their Chinese partner(s) and because the PRC Company Law offers more flexibility than the PRC Sino-foreign Equity Joint Ventures Law, for example. We will concentrate on these negotiations for the purpose of this article.

If a WFOE or a JV fails to complete change formalities before the prescribed deadline, the Chinese authorities may refuse to process registration matters for such company and may report such failure in the company’s information under the enterprise information publicity system, therefore potentially negatively impacting the company’s corporate social credit in the future.

When to start the negotiation?

If the organization form and corporate structure of such FIE is not consistent with the mandatory provisions of the PRC Company Law, as the case may be, such FIE shall complete change formalities within 5 years from the effective date of the FIL (i.e. at the latest on January 1st, 2025). An additional 6-months extension will be granted by the Draft Implementing Regulation to FIE failing to complete such change formalities within the 5-years deadline.

In terms of timing, we anticipate that the Chinese authorities will start requesting existing FIE to update their articles of association before the final deadline for a smooth and gradual transition. We also expect that new practices may take some weeks to be implemented by the Chinese authorities.

The timing for updating the articles of association and any JV agreement will be defined on a case-by-case basis. It will take consideration of an investor’s interests in the update as well as the schedule of administrative procedures to be carried out by the JV in order to avoid delays or blockages with the Chinese authorities.

The new law will have different impacts for investors depending on the voting rights they are entitled to in a JV:

- Majority shareholder: under the PRC Company Law, the following important decisions of a company can be passed upon approval of 2/3 of the voting rights:

- amendment to the articles of association of the company

- increase or reduction of registered capital, and

- company merger, division, dissolution or change of company structure

For example, if you are entitled to at least 2/3 of the voting rights, your JV partner(s) will no longer have a veto right for important decisions.

However, if you are entitled to less than 2/3 of the voting rights, you may expect deadlock situations to occur when minority shareholder(s) are not willing to grant their approval for passing important decisions. In such event, you should make sure that your articles of association and your joint venture agreement identify clearly deadlock situations and a call option right mechanism to purchase your minority partner(s)’ equity in case it/they is/are blocking the decision-making process.

- Share of 50/50 of the JV’s capital: if you have the same voting rights as your Chinese partner in the JV, the new regime will not change dramatically the decision-making process as your partner’s approval will still be required for passing important decisions at the 2/3 majority. As mentioned in the paragraph above, your articles of association and joint venture agreement shall foresee deadlock situations and address them clearly with a call option mechanism that still works. For example, trigger mechanism shall be reviewed as most of the deadlocks were before at the level of the board decisions whereas the law now provides that the highest authority is the shareholders’ meeting.

- Minority shareholder: under the new law, minority shareholders in a JV will no longer have veto rights over important decisions. The need to obtain minority shareholders’ approval in a JV will depend on the capital percentage held by the majority shareholder and on the number of minority shareholders involved in the JV.

For example, if you hold 49% and your partner holds 51% of the JV, your approval will still be required for passing important decisions at qualified majority of 2/3 of the voting rights.

Which items shall be negotiated?

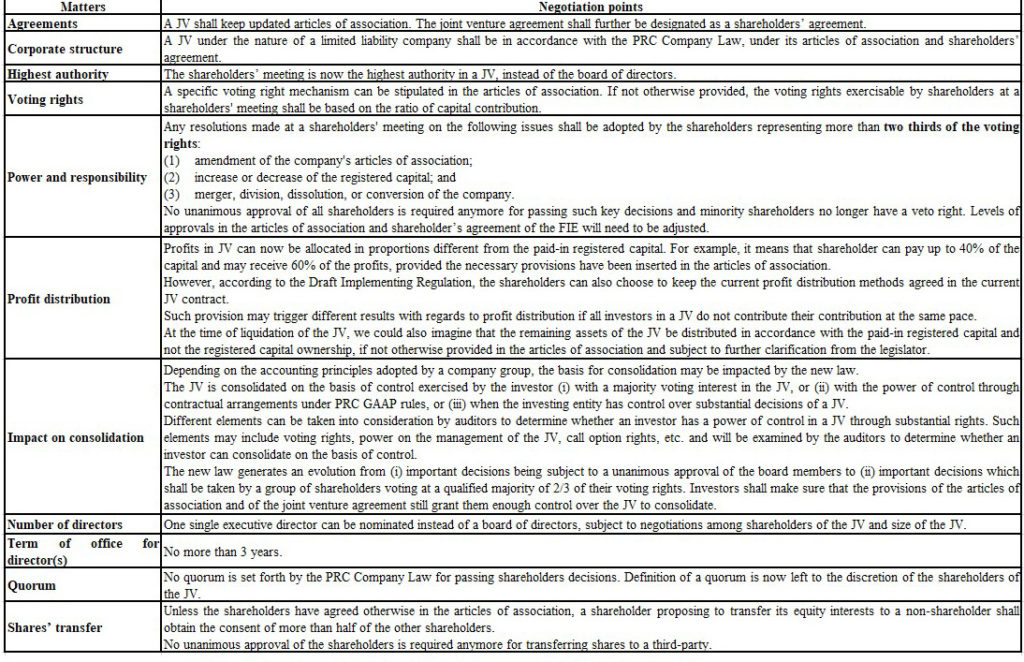

In order to comply with the FIL transition period deadline, foreign investors shall keep in mind that the following key points will need to be negotiated and further updated in a JV’s articles of association and joint venture agreement:

Which matters still need to be clarified?

- Borrowing gap calculation: the FIL and its Draft Implementing Regulation promote equal treatment between domestic and FIE. Articles of association usually provide for a FIE’s total investment and its registered capital.

The difference between the total investment and the registered capital is considered as the borrowing gap, i.e. the maximum amount of foreign debt that a FIE can incur.

The “full-bore macroprudential administration of overall cross-border financing” was introduced by the State Administration of Taxation (“SAT”) as a new method for calculation of the foreign debt capacity and does not include the notion of total investment. In a nutshell, this methodology to calculate the borrowing gap of the FIE expands the capacity of enterprises to engage in cross-border financing. Such calculation method has been used in the China (Shanghai) Pilot Free Trade Zone since 2015.

As per our consultations with the Shanghai governmental authorities, we tend to believe that FIE will still have the option to choose either formula, and that articles of association should still provide for the amount of total investment, until further clarification from the Chinese legislator or governmental authorities.

- Transition process: it is not clear whether the joint venture agreement and the articles of association of the existing FIE need to be revised and whether it is necessary to go through relevant approval/filing/registration process for transition.

It is foreseeable that investors will start a new round of negotiation on the organizational form and corporation structure in relevant investment agreements, including but not limited to the joint venture agreement and articles of association in order to make them in compliance with the FIL and applicable laws and regulations.

Besides, the legislator has not taken a clear position regarding the law applicable during the transition period (either the EJV Law or the PRC Company Law) when the articles of association of a JV are silent on the corporate governance of the JV. For example, as the amendment of articles of association shall be unanimously approved by the directors presented according to the current applicable EJV Law, can a shareholder argue that as the provisions of the PRC Company Law applied to the FIE since January 1st, 2020 and the directors appointed by other shareholders did not agree on the update of the articles of association, any important decision passed after this date by the board of directors is not valid ? We hope that such issue will be addressed in the final version of the Draft Implementing Regulations.

On the overall, the PRC Company Law’s offer more flexible corporate governance mechanisms and will leave more room for negotiations with your Chinese partner than the JV laws.

At the moment, only little guidance has been released for implementation of the FIL in practice, especially in terms of practical details and filing mechanics with the Chinese authorities (for example, whether approval from the Ministry of Commerce (“MOFCOM”) will still be required for some projects). Given the tight legislative schedule, we expect that during the first few months of 2020, broad discretion will be given to the governmental agencies for implementation of the FIL.

The Draft Implementing Regulation has now been submitted to public comments, as the FIL will be effective on January 1st, 2020, we should expect the final version of the Draft Implementing Regulation to be published in December 2019 to hopefully provide further clarifications on the implementation of the FIL.

To know more, please contact:

Bruno Grangier b.grangier@leaf-legal.com

Peggy Wu p.wu@leaf-legal.com

Chloe Voratanouvong c.vorata@leaf-legal.com